Gold price Trading Strategy: Seizing Opportunities Amid Market Corrections

In the dynamic world of financial markets, strategic decision-making is crucial for successful trading. One such market that has historically been a haven for investors is the gold price market. In this article, we will delve into a trading strategy centered around gold price, specifically focusing on selling at the completion of a correction and setting a target price at the 2037 zone, with a risk-to-reward ratio of 1 to 5.

Gold Price Today : Convert Gold Ounce to US Dollar Or vice versa

Gold price chart in U.S. Dollar per ounce, Live gold price chart

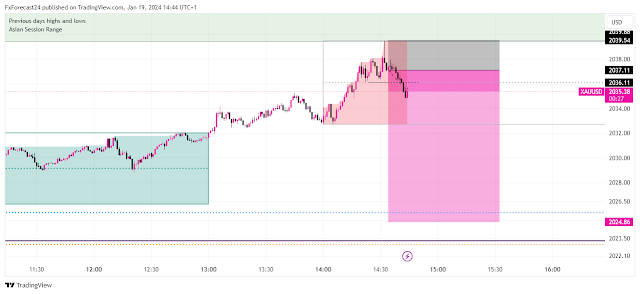

Target Price at 2037 on gold price :

Setting a target price is a fundamental aspect of any trading strategy. In this case, I have identified the 2037 zone as the target price for selling the gold price. This target is selected based on technical analysis and market indicators, suggesting a potential bullish trend beyond this point.

| Gold Price Today | Gold Spot Price Today |

|---|---|

| Gold Price per Gram | $65.89 |

| Gold Price per Kilo | $65,002 |

| Gold Price per Ounce | $2,041.003 |

Risk Management on gold price trade : Risk-to-Reward Ratio 1 to 5

Managing risk is paramount in trading. For this gold price trading strategy, I have established a risk-to-reward ratio of 1 to 5. This means that for every unit of risk I undertake, the potential reward is fivefold. This ratio is designed to optimize the trade by ensuring that the potential gains significantly outweigh the potential losses.

Gold Price Last Week

| Current Price | $65,654.57 |

|---|---|

| Week High | 67,333.3546 |

| Week Low | $65,450.2534 |

| Week Change | -$1,987.81 (1.75%) |

Trade of the day on gold price Today 8th April 2024

Sell limit : 2036

Stop Loss Area: 2040

Take Profit : 2024

Post a Comment