Potential Decline in Gold Price today and a Strategic Selling Approach

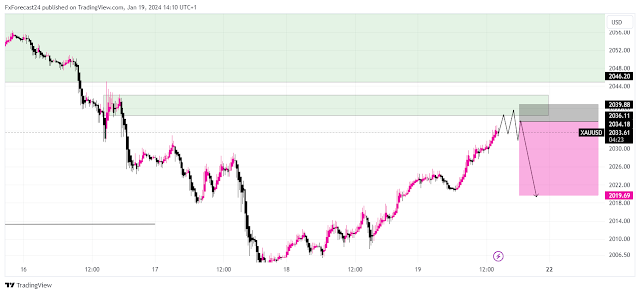

In the dynamic world of financial Gold price markets, investors are constantly seeking opportunities to optimize their portfolios. One such market that has captured the attention of many is the gold price market, known for its historical value and safe-haven status. In this article, we will analyze the current gold price chart and explore the possibility of a decline in prices. The author anticipates a strategic selling approach on gold price, with a planned sale at $2037 and a stop-loss order set at $2039.

Analyzing the Gold Price Chart:

The first step in our analysis involves studying the current gold price chart. Technical analysis is a valuable tool for investors, providing insights into potential trends and price movements. By examining key indicators such as support and resistance levels, moving averages, and trendlines, investors can make informed decisions.

In the presented scenario, the author has identified a potential selling opportunity based on the current market conditions. The decision to sell at $2037 suggests a belief that the price may face resistance at this level. It is crucial to note that technical analysis involves a degree of speculation, and market conditions can change rapidly.

| Gold Price Today | Gold Spot Price Today |

|---|---|

| Gold Price per Gram | $65.980 |

| Gold Price per Kilo | $65,0123 |

| Gold Price per Ounce | $2,041.23 |

Strategic Selling Approach on gold price :

The decision to sell gold price at $2037 implies a strategic approach to capitalizing on the anticipated decline in prices. Traders often set target prices based on historical data, chart patterns, or key psychological levels. In this case, the author has chosen a specific price point as an exit strategy.

Additionally, the implementation of a stop-loss order at $2039 is a risk management technique. Stop-loss orders are designed to limit potential losses by automatically triggering a sale if the asset's price reaches a predetermined level. It is essential for investors to carefully consider their risk tolerance and set stop-loss orders accordingly.

In conclusion, the anticipation of a decline in gold prices and the strategic selling approach outlined in the article reflect the author's analysis based on the current market conditions. However, it is crucial for investors to approach such decisions with caution, considering the unpredictability of financial markets. Implementing risk management strategies, staying informed, and adapting to changing circumstances are key aspects of successful trading. As with any investment decision, thorough research and careful consideration of potential risks are paramount.

Gold Price Last Week

| Current Price | $65,654.57 |

|---|---|

| Week High | 67,333.9786 |

| Week Low | $65,450.3433 |

| Week Change | -$1,9212.81 (1.75%) |

Trade of the day on gold price Today 5th April 2024

Sell limit : 2037

Stop Loss Area: 2042

Take Profit : 2019

Post a Comment